By WendyGMartinez October 27, 2025

Recurring payments are the pillars of any subscription business that thrives. You may be selling a streaming subscription, SaaS application, or a month-to-month membership, auto-billing will get you a stable cash flow and hassle-free experience for your users. Here, we will guide you through the most important steps in accepting recurring payments—from selecting the most suitable pricing model to complying industry standards and winning your customers’ hearts, this guide has you covered.

What are Recurring Payments?

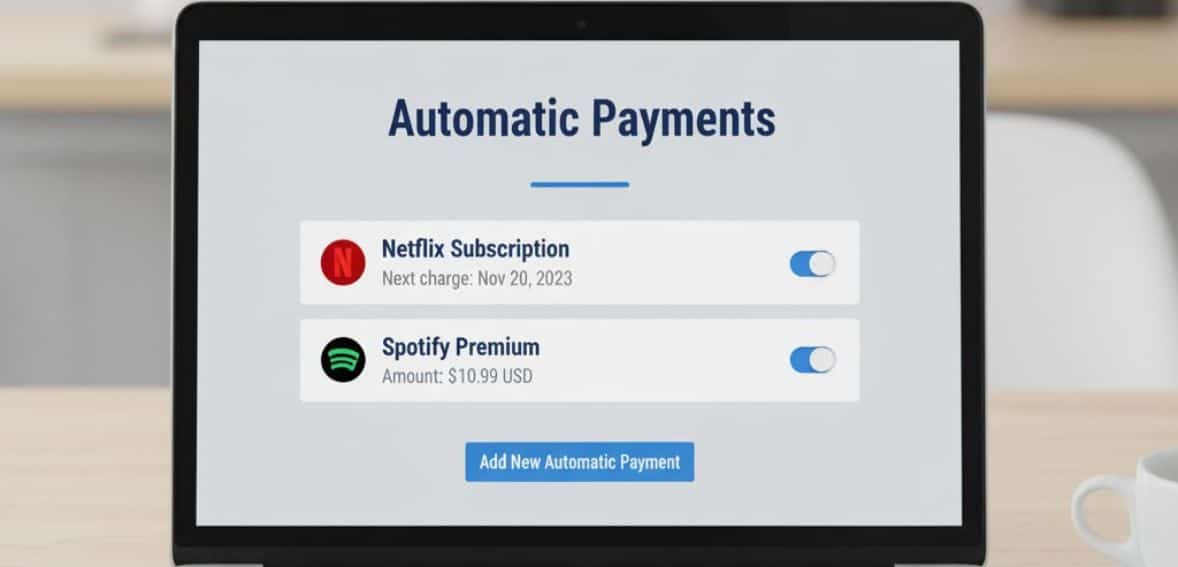

Recurring payments, or also referred to as automatic payments or subscription billing, is a payment that has been established to charge from a customer bank account or credit card on an agreed-upon periodic cycle. They are most commonly applied for services such as streaming services, utilities, membership at health clubs, and software subscription.

Those can be paid by businesses monthly, weekly, annually, or whenever is appropriate for both parties. This provides convenience to customers because they do not have to process every payment individually or suffer hassle due to tardiness. Regular payments means continuous flow of money for businesses, foster customer loyalty, and prevent hours worth of manual billing.

How Recurring Billing Works: A Step-by-Step Breakdown

1. Customer Authorization

It starts when a consumer subscribes to a company on a recurring payment model. On subscribing, they select a billing schedule—e.g., monthly or annually—and accept terms and conditions from the company. The process authenticates the recurring payment model and lays the groundwork for automatic billing.

2. Secure Storage of Payment Information

Next, the customer provides their payment information—usually a credit or debit card. Instead of storing this personal data itself, the system applies tokenization. That is a security process in which real card information is substituted with tokens. The tokens contain no value anywhere except in the payment processor’s system, and even during an attack, the data is safe.

3. Authorizing Payments

After their payment terms are paid securely, the client consents to have the company charge their card automatically according to the plan set. This notifies the buyer that recurring charges has occurred.

4. Automatic Execution of Transaction

After authorizations take effect, at every billing cycle, the system initiates a transaction like an ordinary card purchase. It dials the proper card network, issuing bank in an attempt to get authorization. If authorized, the charge is posted, and the customer is notified.

It will charge most of its customers by email once it has been successful at charging them. They’ll even receive reminders in advance before the charge sometimes.

How to Accept Recurring Payments for Subscription Businesses

Implementing recurring payments for a subscription business is not just about automating charges—it’s about building a system that sustains trust, provides value over time, and accommodates long-term growth. The following is the step-by-step breakdown:

1. Understand Your Business Model First

Prior to offering recurring payments, your business model must be suited to it. Subscription billing is best suited for products or services that provide ongoing value—such as video streaming, software-as-a-service (SaaS), gym membership, or subscription boxes. In the event your product or service entails extended access, recurring payments can be utilized to automate processes and improve customer satisfaction.

2. Select a Pricing Structure That Suits

The correct pricing model is crucial. Based on your product and market, you might use a flat-rate model (one single fee per cycle), tiered pricing, user-based, use-based pricing, or a freemium model where basic access is free, but you pay for additional features. What you essentially need to do is equate price with the perceived value customers will pay on rare events.

3. Select a Trustworthy Payment Gateway

Your payment gateway is the foundation of your invoicing. Pick one that is secure (PCI DSS compliant), has automation elements such as retry payments and dunning management, and integrates into your current tools. Some popular ones are Stripe, PayPal, Razorpay, and etc. A solid gateway makes your transactions smooth, secure, and scalable.

4. Follow Legal Legislation

Follow-up is the key to handling your customers’ payments and your data. You will need to adhere to mandatory laws in your sector and the nations in which you are operating. These include data protection regulations (e.g., GDPR), consent procedures, and payment authorization details safeguarding. You will lose money and reputation if you do not obey.

5. Set Up Your Recurring Billing System

After selecting the payment gateway and pricing plan, set up your recurring billing system. Specify billing periods (month, quarter, year), right charges by plan, and permit whether you want automatic invoicing and receipts or not. You might also want customer segmentation—subscribing classes can be allowed to have different billing rules or perks.

6. Provide Multiple Payment Options

To facilitate payments from customers, provide them with multiple payment options. These can include credit and debit cards, digital wallets, UPI, bank transfers, and even BNPL programs, depending on where your business is located. The more fluid and local your options are, the higher your rate of success in checkout friction reduction as well as customer retention.

7. Obtain Detailed Customer Authorization

Recurring payments need clear customer consent. Ensure that they know what they are consenting to and freely agree to it before charging them regularly. This can be done using a sign-up box, OTP verification, or electronic signature. Always keep this authorization safe for your own use.

8. Share Payment Information Clearly

Transparency leads to trust. Be open with customers regarding what they are going to pay, when, and how to modify or cancel a subscription. Confirm by email upon sign-up, notify them of renewal with notice, and permit the request or change of a bill. Communication eliminates and prevents avoidable disputes or chargebacks.

9. Anticipate Payment Failures

Regardless of the best setup, there will be declined payments—due to the card expiring, low balance, or technical fault. You must automate the processing of this by re-sending payments after some time gap, informing the client, and providing an opportunity for them to re-submit their payment mode. You can also provide them with a grace period before cancellation of their service to build a more better customer relations.

10. Be Great at Customer Support

A great service team that can respond well makes or breaks the customer experience. Make sure your service team is capable of assisting with billing problems, cancellations, or payment failures. Fixing problems with friendly, fast support not only fixes problems but could even prevent possible chargeback and drive loyalty.

Benefits of Recurring Payments

The following are some reason why taking recurring billing will be an excellent decision:

1. Stable and Predictable Cash Flow

One of the greatest benefits of recurring payments is that it brings stability to your cash flow. Rather than being bothered with uncertainty of one-time transactions, you’re receiving revenue on a predictable cycle. This stability lets you have more control over your operating expenses, budget more effectively, and make strategic choices with more confidence.

2. Scalable and Flexible Billing

As your customer base expands, so does recurring billing. Instead of paying extra cash to upgrade or switch, customers are able to flow easily into a higher-plan level or add features. Billing flexibility of this nature allows users to remain with you for months and months, which provides the opportunity for long-term relationships to be built and lifetime customer value to be revealed.

3. Greater Attraction to Investors

If you must raise funds or find investors, recurring revenue puts you in the driver’s seat. Stable, predictable income decreases business risk and boosts business value. Investors like subscription-based business since they offer good revenue visibility and greater financial stability in case of market volatility.

4. Better Customer Experience

For the consumer, automatic recurring payments are convenient. They don’t have to mail in checks each month and can’t miss a payment or get cut off. It’s a cleaner, neater experience that fuels retention and overall satisfaction.

5. Lighter Administrative Burden

Automating bills gets rid of the time your staff takes looking for bills or paying bills manually. It spares administration hours and allows your staff to concentrate on development work, customer service, and product innovation instead of hanging around on day-to-day billing work.

Conclusion

Handling recurring payments is not a tech solution—it’s a strategy that can grow, automate, and increase subscriber retention. With the right choice of price, use of a secure payment gateway, and transparency to your subscribers, you can create a simple, trustworthy billing process that makes business successful. With the proper system, recurring payments can be the most profitable platform for your subscription business.

FAQs

What is a recurring payment?

Recurring payments are regular, routine withdrawals from the customer’s account, e.g., monthly or annually, for regular services or subscriptions.

Are recurring payments approved by customers?

Yes, the customer will have to give consent in advance before being charged on a recurring basis, e.g., at sign-up.

Are recurring payments reversible by customers?

Yes. Clients may cancel at any time in account management or through your support hotline, at your discretion, according to your cancellation policy.

Are automated payments secure?

Yes, most payment gateways store customer information securely with encrypted and tokenized measures, which ensures payments are processed securely.

What happens with a failed recurring payment?

If there was an unsuccessful payment, systems will automatically attempt again and notify the client, so they are able to change their payment method.